The UK economy has been badly affected by Covid. So why are house prices still rising? We look at the factors and ask whether now is the right time to buy.

On the face of it, it really doesn’t make sense: coronavirus has left many businesses struggling. Redundancies are rising. These are uncertain times and perhaps not the obvious moment to make big financial decisions.

And yet, the average price for a house in Britain just hit a record high. During September, prices rose in every region of England and Wales except the South West and the North East (where they held steady). In a year, UK prices have risen by 2.5% and in the North West that rise is even greater at 3.5% (making it one of the most buoyant regions of all right now).

As you might expect, there seem to be several factors at play.

Pent up desire: The three months of near total lockdown earlier this year put the brakes on virtually everyone’s moving plans. Once restrictions began to lift, people resumed their house hunting. Only now, with lots of people squeezed into the market at once, demand rose – and so did prices.

Race for space: The pandemic has clearly changed the way some people have felt about their previous living arrangements. After three months effectively locked in their homes, some have realised that it’s not the home for them. They are looking to move so that, when the next pandemic arrives they have more space inside and perhaps some space outside too. Some have even made the decision to switch town for country.

We’ve certainly spoken with many more people who have found themselves reassessing their life goals in the light of the past few months. Where they choose to live is, of course, a crucial element in that.

Independent living: Lots of young people raced back to mum and dad’s at the start of the lockdown seeking company, security and (almost) rent-free living. Post-lockdown, many of those same young people are now eager to have their own space again.

Boosted savings: 2020 was the year holidays went unbooked, big celebrations were postponed till next year and money that would usually be spent wasn’t. For some people saving for a deposit, that meant savings grew far quicker than expected.

Low interest rates: Interest rates have been low for a long time, so we can’t say they are a new factor in driving rising house prices. But what is different is that there is little ‘noise’ about rates rising anytime soon. In fact, we’ve recently seen the Bank of England exploring the idea of negative interest rates. That doesn’t mean we’ll see them, but it does indicate there’s no major desire to see rates rise. And the longer they stay low, the more affordable your mortgage is.

Stamp duty freeze: Last year, if you had bought a house for more than £125,000, you would have paid Stamp Duty Land Tax on it. Rates increase depending on the cost of the house. For a £300,000 house, for example, you would have paid £5,000 in duty. Right now, however, the freeze means you pay no stamp duty on a first home up to the value of £500,000. This arrangement ends on 31 March 2021, however, further encouraging buyers to buy now.

Stability and security: We won’t revisit the renting vs owning arguments here, but it’s certainly true that the past few months have left more people feeling as though they want greater stability and security, and they are looking for that by buying rather than renting.

Buying in a booming market doesn’t sound like a great idea, but this market isn’t like any other. The stamp duty freeze combined with low rates may offset some or all of the increased price you pay for any property. Buying habits are continuing to change and, whilst none of us has a crystal ball, what may seem like an inflated price right now may look like great value in just a few months’ time – especially in the areas that have been most sought after.

And if you are eager for more space, independence or security following the past few months, chances are you’ll be willing to stand an additional percentage point or two, providing you can find an affordable mortgage to help you buy.

And for that, talk to us.

Happy New Year from the Key Mortgage Advice team! 2019 was a year of change for us, and a year of our continued effort to make jargon-free mortgage advice available to as many people as possible; whether that's over the phone or in your office!

Follow us on a journey through our key moments of the past year...

In April, our MD Sharon sat down with Arin West from WestCoastCo. and the Ethical Marketing In Action podcast to discuss our core values, what we love about our work and our thoughts on using Facebook to advertise products and services. Listen to that episode here.

April also saw the introduction of a new member of staff to our Preston team; Jane Davis. Find out more about her here.

We hit a major social media milestone in July when we reached a fantastic 500 followers on Facebook!

This month, we were lucky enough to be invited into Sofology to host a Financial Awareness Clinic with their staff. The one to one meetings are held with any staff members interested in obtaining help and advice on all mortgage and debt related topics, and we absolutely love doing them! If you'd like to run an event like this for your staff, get in touch. We'd love to be involved!

In August, we were treated to the most creative testimonial we've ever received - eat your heart out William Wordsworth!

We were also lucky enough to be invited to Southport Flower Show's special ladies' event to raise money for Alder Hey Children's Hospital. Not only was this a wonderful excuse to dress up, but with over 350 women in attendance, over £3,000 was raised!

September was all about preparing for the launch of our brand new website. We introduced the client portal this month, which will allow our clients to send us private and personal documents or information in a safe and secure manner rather than having to email or post it to us. If you're an existing customer, you can log in here.

Our team also brushed up on their modelling skills this month with some impromptu photoshoots for the new website - as you can tell, we had a great time!

September also saw our team diving into the wonderful world of Pinterest. Scan our pin code here for interior design inspiration and access to our archive of blogs!

October was a big month for us at Key Mortgage Advice, as we launched our brand new website with WestCoastCo! This new website was built around the concept of making mortgages friendly, and as accessible as possible with our calculator, portal and booking system.

The team definitely deserved to let their hair down after such a busy year, so a Christmas party was in order! We enjoyed an evening of Alice In Wonderland themed festive magic at the Bliss Hotel in Southport.

In 2020, we aim to bring our friendly and professional service to even more lovely customers! Whether that's in your office, our office, or at one of our many events, we're here for you and ready to help you to take that first step to purchasing your dream home or commercial property in 2020.

With Brexit seemingly just around the corner and the possibility of further increases to the base rate, 2019 looks set to be a volatile year for the mortgage market.

While this could be a cause for concern in the long run, current uncertainty means that competition between mortgage lenders is fierce and opportunities for you to grab a great deal are plenty. So, whether you're a first-time buyer or a buy-to-let landlord, being proactive in the early part of the year could end up saving you thousands. Here's a rundown of the trends we expect to see emerge in the mortgage market over the course of 2019:

The number of first-time buyers being accepted for mortgages with low deposits is increasing, signalling that now could be a good time to land a great deal if you're looking to get on the property ladder. This price drop for 95% mortgages is in contrast to the current trend at lower loan-to-value (LTV) levels, where rates have been rising. The battle for new mortgage customers should continue, meaning even more competitive rates could potentially become available. Here are some other possible changes which would also benefit first-time buyers:

Young people are finding it increasingly difficult to save a deposit and, in response, the Building Societies Association has been trying to convince its members to be more lenient when it comes to first-time buyers. Since the financial crisis in 2008, 100% mortgages have disappeared. Whilst bringing them back would be a controversial move, there's a good chance of these deals coming back to the market in 2019. If they do, they'll probably be reserved for people in certain professions or those with a very strong credit record and proof of significant income.

Professional mortgages started to make a comeback towards the end of 2018, and they should continue to grow in number over the next 12 months. Lenders usually cap their offers around 4.5 times the annual income of the applicant (combined income if it's a joint application), but professional mortgages allow those in certain professions (e.g. doctors and dentists) to borrow up to 6 times their salary. Lending at multiples of over 4.5 is considered to be a risk, however, the high levels of competition could see more lenders offering these types of deals in the future.

![]()

Second steppers can often have a harder time finding a mortgage for their next home than they did finding their first. Low wage growth and increasing house prices have created an affordability gap which can be hard to overcome. With uncertainty around Brexit becoming a major concern, many are resolving to stay put, which could mean that lenders are incentivised to offer low-cost remortgage deals in the near future.

If you're looking to remortgage, you're most likely looking for a deal with an LTV ratio around 60-80%. Historically, these LTV levels have offered great rates. However, they've been creeping up in price in recent months. With further increases to the base rate on the horizon, the chances of rates coming down are low. Longer-term fixes will offer the best value in this area of the mortgage market and cashback/fee-free incentives will grow in number as lenders look to woo remortgage customers.

Everybody knows by now that staying on your lender's standard variable rate (SVR) costs you thousands more than the best deals. If you're looking to remortgage, now represents an opportunity to do so at a great rate. Five-year fixed-rate mortgages are increasing in popularity and, as such, offers are becoming more competitive. With switching offering savings of up to £4,000 per year, many people are likely to opt for a deal of this kind in 2019.

Last year, lenders began offering remortgaging products to those with Help-to-Buy equity loans. Most of the deals on offer, however, require you to pay off your equity loan in full, with little available to those who can't afford to do that. More people are coming to the end of their fixed terms in 2019, and as such, we expect to see more lenders launching mortgages for those with Help-to-Buy loans.

Landlords have had a tough time over the last couple of years, but 2019 might just offer some relief. New affordability criteria introduced in Autumn 2017 have made it harder for some landlords to secure loans, with lenders increasing the minimum interest cover ratio (ICR) to 145% or more. This means that rental income has to be at least 145% of the proposed mortgage repayments before they'll approve a loan. Lenders are beginning to relax their ICRs, with deals now available at an ICR as low as 125%. This should encourage more lenders to follow suit, meaning the buy-to-let mortgage market could become a little more enticing to would-be landlords.

In October last year, five-year fixed-rate mortgages for landlords hit an all-time low of an average 3.4%. Lenders also began to offer ten-year fixes on buy-to-let mortgages, another proposition which could increase in popularity throughout 2019. As with remortgages, fee-free deals are growing in availability, as lenders seek to tempt landlords who are looking to refinance their portfolios. Cashback offerings on buy-to-let mortgages also look set to increase over the coming year.

The easiest way to find a great mortgage deal is to speak to a broker with access to the whole of the mortgage market. Whether you're buying your first home or looking to grow your property portfolio, Key Mortgage Advice can help you find a mortgage perfectly suited to your circumstances, usually at no extra cost! Visit the Contact Us page and fill in our simple form to get a free callback!

Do you struggle to come up with a theme when it comes to Christmas design and decoration? Are you sick of the sight of your tired old ornaments and looking for something new? Don't panic, we're here to help!

Trends seem to come and go faster than Santa delivers presents on Christmas Eve - but we've found a few Christmas design trends from 2018 that put a twist on the traditional and are sure to remain in fashion for years to come - so you won't need to replace your decorations next year to keep up with the neighbours!

Does the thought of vacuuming up pine needles make you shudder? Do you have a pet with a penchant for climbing? No problem!

You can construct a modern, minimal Christmas tree from reclaimed wood, cardboard, or even repurpose your bookshelf! This quirky new trend takes all of the hassle out of decorating the Christmas tree and, done right, can look sleek and stylish. Why not see what you can find around the house and garden? Making a tree is just as entertaining for the kids as decorating a traditional one and might keep them quiet a little bit longer!

Speaking of keeping the kids quiet, budding little artists can be entertained for hours by making Christmas ornaments (and it'll save you a few quid!)

Round them up and get them cutting, sticking, and painting! Not only will it keep them busy, but you'll get something of sentimental value that you can keep forever. Baking ornaments from cookie dough or gingerbread is another fun, festive activity. Although, edible decorations might not hang around quite as long!

As Christmas design trends go, golden colour schemes are nothing new - but there's a reason gold is so popular - it's absolutely gorgeous!

Try pairing golden decorations with hints of red to create a glorious autumnal colour scheme. Not only will your home look wonderful, but it will feel lovely and warm as well! Or, for an extra lavish vibe, go all out with all-gold everything!

Muted colour schemes are becoming increasingly popular in Christmas design, and for good reason!

Aside from being strikingly beautiful, mixing stark white decorations with soft, muted colours gives a luxuriously modern look without being too garish. There's also the added bonus of being able to easily match this type of design to your home decor. No more Christmas design nightmares!

Finally, everyone's favourite part of Christmas - the presents!

Whilst everyone loves receiving gifts, wrapping them can be a real pain! Especially when you can't think of a theme or an original greeting to write on the tags. Rather than defaulting to that horrifying bright red paper with the penguins on (we've all got a roll stashed away somewhere), try something different with earthy tones. Natural items like pine cones and Christmas tree clippings make great alternatives to gift tags and complement this colour scheme nicely. They also save you the headache of thinking of something to write!

The team at Key Mortgage Advice would like to wish everyone a very merry Christmas and a happy new year! If you're thinking of moving home in 2019, give us a call or send us an email and we'll help you find the perfect mortgage deal. You can find our details on the Contact Us page.

As the nights draw in and temperatures drop, it’s worth checking if you’re eligible for one of the many available grants. The government have put aside millions of pounds to assist with energy bills or improving your home’s energy efficiency, so don’t miss out!

A grant is money (or sometimes a voucher) given to you to cover a specific cost. In this case, we’re looking at grants which are intended to assist with the cost of keeping your home nice and warm over winter.

Some grants are offered by a specific energy supplier and used as an incentive to get you to switch provider. This means that, even after the grant, you’re not necessarily getting the cheapest deal. Be sure to shop around to make sure you couldn’t find a more suitable deal elsewhere.

A good place to start in your quest for energy grants is the Energy Saving Trust website and Simple Energy Advice. They can point you towards any government-backed grants or those being offered by your local authority.

These grants can lead to an increase in your home’s value as well as its warmth and efficiency.

Many of the biggest energy suppliers are offering free boilers and/or insulation to people receiving certain benefits. This is part of the Energy Companies Obligation (ECO) scheme. A new boiler costs just over £2000 on average, so this is a fantastic offer if yours is past its best. It could also save you up to £350 a year on your gas bill thanks to increased efficiency.

Getting cavity wall insulation can knock up to a whopping £250 off your energy bills each year, according to research by the Energy Saving Trust. Loft insulation can save you a further £220 per year, so these deals are worth grabbing if you have the chance. Just be sure that cavity wall insulation is appropriate for your home, as in some cases it can cause damp.

These offers tend to be reserved for those on tax credits or income-based benefits like income support and pension credit.

The energy companies involved in the scheme are:

• British Gas

• Co-operative Energy

• Economy Energy

• EDF Energy

• Eon

• Extra Energy

• First Utility

• Npower

• Ovo

• Scottish Power

• SSE

• Utilita

• Utility Warehouse

If you’re with one of these suppliers already, they should contact you if you’re eligible. However, if you think you fit the requirements or are thinking of switching supplier to get the ECO grant, it’s worth contacting them.

The Warm Home Discount scheme requires big suppliers to help those in the UK most in need to pay their energy bills during the colder months. If eligible, you could get a £140 discount on the energy you use between October and March.

Those on pension credit and those on a credit meter should automatically get this reduction on their bill. If you have a prepay or pay-as-you-go meter, you’ll need to apply. Low-income households also qualify for the discount.

If you qualify for the rebate, you should receive a letter before December 7th 2018 telling you that you're eligible for an automatic discount, or that you need to apply for it. If you need to apply, the cut-off date varies by supplier, so give them a call as soon as possible. The payment needs to be made before March 31st 2019, so make sure you apply in good time.

If you were born before November 6th 1953, you’re entitled to a tax-free winter fuel payment of between £100 and £300 to help with your energy bills. The money comes from the government, and should arrive in your account before Christmas! The exact amount you’ll get depends on your personal circumstances.

If you receive a state pension or get another form of social security benefit (e.g. pension credit, jobseeker’s allowance or ESA) you should get the payment automatically.

If you’ve never had the payment before and aren’t receiving a state pension or social security benefits, you’ll need to apply.

The cold weather payment is another government grant for older people and those on certain benefits. If the average temperature is forecast to be 0°C or below for a week or more between November 1st 2018 and March 31st 2019, then you’ll receive £25. You’ll get £25 for every period of seven consecutive days of cold weather, paid into the same account your benefits go into. You should get the payment within 14 days of the cold spell.

All UK residents in receipt of pension credit qualify for the payment. As do those on income support, jobseeker’s allowance, ESA or universal credit who also receive a disability or pensioner premium and/or have a young child (under 5) or child with a disability living with them.

The payment should be automatic but check with your Jobcentre or pension centre if you don’t receive it within 14 working days.

Many utility companies have an energy fund scheme to help with arrears if you’re struggling financially. They can help if you have large arrears on your gas, electricity or water bills.

In order to apply, you’ll need to complete a full income and expenditure budget sheet and provide proof of your income. You’ll also be required to provide details on how you got into arrears, e.g. due to illness or redundancy, and explain how the grant will help you.

The eligibility criteria vary from provider to provider, so you’ll need to contact the company you’re in arrears with to find out if you’re eligible for a grant. Some require you to be in receipt of certain benefits, but this isn’t always the case.

The process can take several weeks, however, it’s worth it if you’re facing financial hardship.

Your mortgage is likely your biggest financial commitment. So, if you’re looking for other ways to save money, come and speak to one of our advisors about finding a better deal. You can find our details on the Contact Us page.

Towards the end of 2018, Philip Hammond delivered the annual budget to MPs in the house of commons. Included were details of the money being put towards housing and changes to the Help to Buy scheme.

It was revealed that a further £500 million would go to the Housing Infrastructure Fund - meaning there will be £5.5 billion in the pot, in total. This will allow for a further 650,000 homes to be built in partnership with housing associations across the country.

Mr Hammond then announced details of an extension to the Help to Buy scheme, which had been scheduled to end in April 2021. The scheme, which allows homebuyers to purchase newly-built homes with only a 5% deposit, will now continue to run until March 2023. However, he also added that the government has no intention to introduce another Help to Buy product once the scheme has ended, suggesting that there is limited time left for homebuyers to benefit from government assistance.

Under the current scheme, buyers receive between 20% and 40% of the cost of a new house from the government, in the form of an equity loan. This loan is interest-free for the first five years and can be paid off at any time. The cap for the value of the property is set at £600,000 nationwide. By April 2021, the government will have loaned 360,000 homeowners an impressive £22 billion.

Help to Buy currently supports around 33% of housebuilders’ private sales and around 20% of buyers taking advantage of the scheme are already homeowners.

From April 2021, the scheme will become more restrictive. Firstly, only first-time buyers will be eligible for a Help to Buy loan. Secondly, the £600,000 cap on the value of purchased property will be replaced with a location-dependent price cap.

The new price cap will be set at a price calculated as 1.5 times the average regional first-time buyer property price. In London, the cap will remain at £600,000. At the other end of the scale, in the North East (where property is much cheaper) the cap will sit at £186,100. Here in the North West, buyers will be capped at a property price of £224,400.

*According to HM Treasury analysis

It was also revealed that stamp duty for first-time buyers of shared ownership property up to £500,000 in value would be abolished. This will be applied retrospectively to the date of the last budget (November 22nd 2017.)

New research by consumer group Which? has found that less than half of UK homeowners know the exact mortgage rate they are paying. Over a third of those surveyed had no idea at all what rate they were on. Only 27% of people were able to recall their exact mortgage rate and 25% were found to be on SVR mortgages - a statistic which is worrying, at best.

SVR mortgages (standard variable rate) are mortgage providers' standard deals, which you are put on once the introductory period of your mortgage comes to an end. The rate varies from lender to lender and is affected by changes to the Bank of England's base rate, among other things. Most importantly, however, it is almost always significantly higher than the rate you were originally paying. The survey by Which? gave Clydesdale Bank as an example. They offer a market-leading initial rate of 1.79% during the introductory period, but then the rate jumps up to 5.2% (variable). That stands above the average SVR mortgage rate, which (according to Moneyfacts) is 5.11%.

Researchers looked at what this would mean for a person who bought a house at the average UK price (£231,422) on a 90% LTV mortgage. Paying back a £208,279 loan over a 25-year term, they could pay as much as £347 a month more once the introductory period is over and they lapse onto the SVR. This would cost them more than £4,000 extra per year!

Anyone who has come to the end of a fixed term (usually 2 or 5 years) and hasn't remortgaged is likely to be on their lender's SVR. A shocking generational disparity shows that almost twice the number of those in the 60-69 age category were on SVR mortgages (34%), compared to just 18% of 25-34 year-olds.

Our Director, Sharon Duckworth, says: "It's worth checking to see if you're on an SVR mortgage, as you could be wasting money. The market is very competitive at the moment and there are some fantastic mortgage deals for homeowners to take advantage of."

Which? found that, of those who had had their mortgage for more than 5 years, only 50% said they were happy with their deal. Alarmingly, 41% of all homeowners on SVR mortgages said that they would be "unlikely to switch if they came across a cheaper deal today". Reasons given for not switching from SVR to a better deal were that “it wasn’t worth the hassle” and “they hadn’t thought about it”. However, only 17% though that it "wasn't worth their time".

Today, other types of mortgage deals offer much lower average rates, including fixed (2.98%) and tracker (2.81%). Compared to the average SVR (5.11%), they offer exceptional value.

If you're thinking of remortgaging, it's worth speaking to a whole-of-market advisor, who will have access to all of the best available deals. Key Mortgage Advice are one such advisor, with offices in Preston, Garstang and Southport. You can arrange a free mortgage consultation with us via phone, email, or by popping in to see us. All of our contact details can be found on our Contact Us page.

Fine & Country have joined Key Mortgage Advice in the Resource Centre in Garstang!

Established in 2001, Key Mortgage Advice now have high street offices in Preston, Southport and Garstang. With almost eighteen years of experience in the property sector, the company has established countless relationships with estate agents throughout Lancashire and Merseyside, and managing director, Sharon Duckworth, is delighted to be welcoming a new estate agent to work alongside them in their Garstang office.

“Cultivating great relationships with local businesses means that we’re able to offer a better, more personal service for our clients, so working closely with Fine & Country in Garstang is something we’re very excited about”, explains Sharon.

Fine & Country is a global network of independent property professionals who aim to provide personal, local expertise for their clients. Dealing exclusively with prestigious, high-end properties, they hope to provide an entirely different service for Garstang residents. Offering both regional and national advertising with a comprehensive online presence and strategic offline approach (including their own magazine; Refined), Fine & Country pride themselves on providing their clients with access to a global market.

“Both Fine & Country and Key Mortgage Advice offer a truly personal experience”, says Andrew Kneale, director of Fine & Country.

“We definitely have a shared ethos, and we’re hoping that by working together closely we can really offer a holistic approach for our clients in Garstang.”

Key Mortgage Advice and Fine & Country are both based at The Resource Centre on Bridge Street in Garstang and are available for consultations by appointment.

To arrange a free consultation with Key Mortgage Advice in Garstang, covering a vast array of mortgage options as well as their fully-managed Mortgage Plus service, call 01995 676211 or visit the Contact Us page. We also offer independent mortgage advice in Southport and Preston.

To find out more about Garstang’s newest estate agents and to arrange a consultation with one of Fine and Country’s passionate property professionals, call 01524 380560.

As people become increasingly aware of their environmental impact, making your rental property more environmentally friendly can give your profits a real boost and help attract tenants.

In April 2018, a new legislation - the Minimum Energy Efficiency Standards (MEES) - came into effect, requiring every residential rental property to have an EPC rating of E or better. It is estimated that some 30,000 rental properties across the country were immediately affected by the changes.

According to the new regulations, landlords of properties with an EPC rating below an E cannot grant a new tenancy, nor renew an existing one, unless they have registered an exemption. These rules will apply to all tenancies by April 2020.

Although some landlords will see these new regulations as a hindrance, they offer an opportunity to give tenants what they really want; not only does an eco-friendly approach help save on fuel costs, it can provide greater convenience and give your rental properties a unique selling point. So, if you’re looking to boost the green credentials of your property, follow these minimum-fuss, maximum-impact tips:

High-quality insulation is the first step to creating an eco-friendly living space. Ensuring that heat lost via lofts and wall cavities is kept to a minimum will have an immediate and lasting effect on fuel costs, reducing them drastically.

Whilst original fireplaces make attractive features, leaving them unmanaged will have a significant impact on your property's energy efficiency and could undo your hard work in other areas. If the fireplace is unused, fitting a chimney balloon is the simplest solution. The balloon is inserted up the chimney and inflated, blocking draughts and stopping heat from escaping. They are also easy to remove, should you want to call the fireplace into action again at any point.

Swapping your lightbulbs for LED alternatives is one of the cheapest and easiest switches you can make. LED bulbs can last up to 21-times as long as traditional ones and are even more efficient than the CFL bulbs used in most homes.

With the average power shower using around 22 litres of water per minute, despite being desirable for tenants, they're not particularly eco-friendly! Provided the water pressure in your area is good, a water-saving shower head should have a minimal impact on your shower's effectiveness whilst making water wastage a thing of the past.

Every flush of the toilet uses up to 12 litres of water, a scary proposition when you consider how many times an average family uses the toilet per day! The old brick-in-the-cistern trick might be appropriate for residential homeowners, but it might be a good idea to fit a proper low-flush toilet in your investment property!

Thermostatic valves shut off radiators when they reach the desired temperature. Fitting the valves is easy and relatively cheap (each valve costs between £10 and £20) and can make a huge difference to the fuel efficiency of your property. They are an affordable alternative to the increasingly-popular underfloor heating option, which can be very costly.

Smart thermostats, like the popular HIVE designed by British Gas, allow tenants to control the property's heating remotely. Meaning they can come back to a warm house on a winter evening without leaving the radiators on all day. They are an ideal solution in terms of preventing energy waste and saving money, and they relatively inexpensive to fit.

Your Energy Performance Certificate is the document showcasing your property's energy efficiency credentials, so make sure you have it updated and make your hard work count! An EPC lasts ten years, so you may not need to have a new assessment legally, but an old rating will mask the changes you have made. Ensure you show the assessor the paperwork detailing the work you've had done and allow them access to any areas where changes have been made (loft etc.) so they can effectively assess your property.

Once your existing portfolio is up to scratch, you might like to think about expanding and buying another property. Before you do, get in touch with us so we can help find you the best possible mortgage deal!

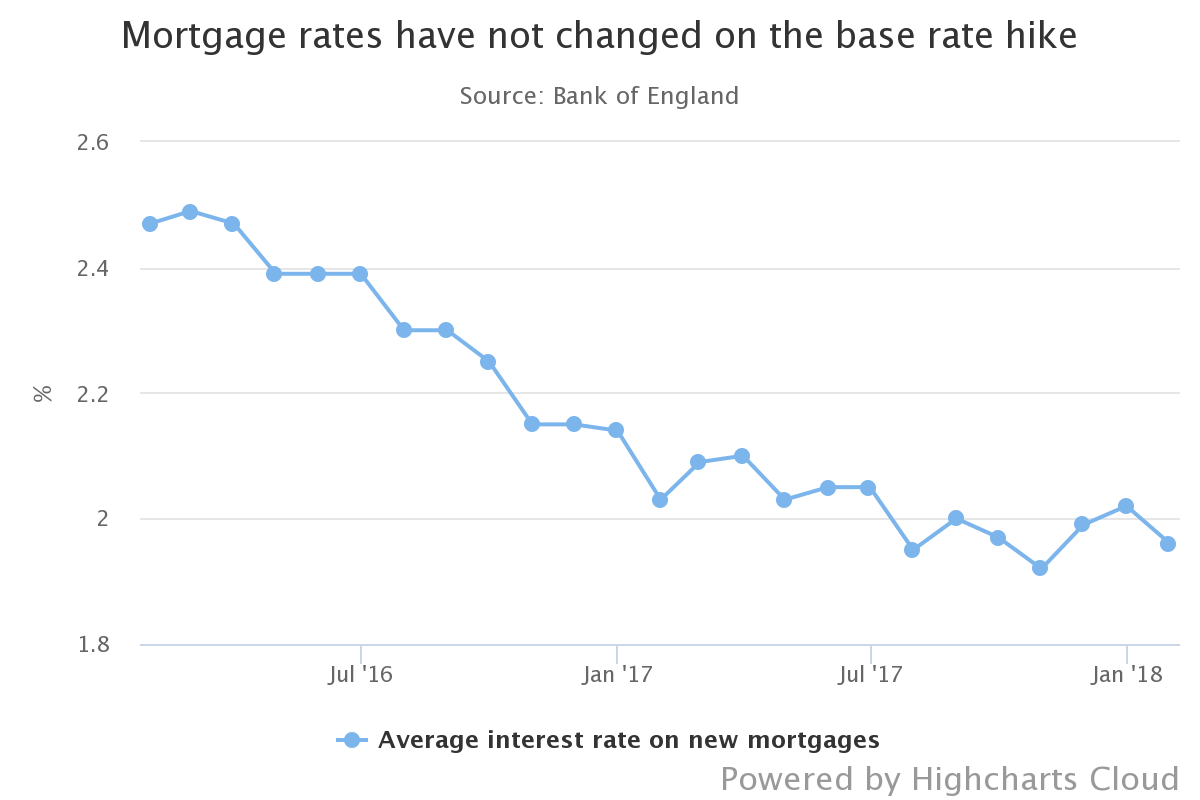

There has been little change to the best fixed-rate mortgage deals on offer, despite the base rate being increased four weeks ago. Some lenders have even reduced their rates, suggesting there's still time for people nearing the end of their contract to secure a better deal.

The Bank of England increased the base rate from 0.5% to 0.75% at the beginning of August, meaning those on SVR or tracker mortgages will see their payments go up, with many lenders bringing these changes into effect this weekend. It was expected that fixed-rate deals would also be impacted by the change to the base rate, however, they have largely stayed the same since the hike. This could be because the base rate increase had already been factored into current prices - rates have been rising steadily since their lowest-ever point last November.

Rates remain historically low and are only expected to increase. Those looking to remortgage or purchase a property within the next six months might want to think about locking in a great deal today, whilst they're still available.

Movements in the rate for fixed mortgage deals have been tiny, so far. Since the base rate hike, the best two-year fixed-rate mortgage deal has increased by just 0.03% (was 1.35% now 1.38%). The best five-year fixed deal has not increased at all (1.83%). These examples assume a £200,000 property with 60% loan-to-value.

A few lenders (including Barclays) have even reduced their rates on fixed-rate mortgage deals, though they're still not the cheapest. This is probably in order to remain competitive.

However, there's no guarantee that the increase in the base rate won't have a larger impact on fixed-rate deals going forward. So, if you're thinking of applying for a mortgage in the near future, it's worth seeing what's available to you today.

If your current deal ends within the next six months, or you're looking to buy a property in that time, start looking at mortgage deals now. Most lenders have a "lock-in" period, meaning you can secure a deal at today's rates to start at any time within the next six months. Some lenders have even longer lock-in periods, allowing up to twelve months, though usually only for those purchasing a new build.

Anyone who hasn't reviewed their mortgage for a while should take action now to see if they can make a saving. Taking advantage of the current low fixed-rate deals could also protect against future increases in interest rates. Even those still in a deal can secure a low rate now which will still be valid when their contract comes to an end.

For free, impartial advice from friendly experts in the mortgage market, book a consultation with Key Mortgage Advice via the button below. We have offices in Southport, Preston and Garstang, or we can assist you over the phone.

On Thursday, following a meeting of the Monetary Policy Committee, the Bank of England increased the base rate from 0.5% to 0.75%. This is the highest the base rate has been since 2009 and the rise has prompted many homeowners to consider looking for a fixed-rate mortgage deal.

The base rate is the interest rate set by the Bank of England Monetary Policy Committee and is the official interest rate used by Banks and Building Societies to calculate the rates for their products, including mortgages, loans, and savings accounts. Often, when the base rate goes up, so does the interest you pay on loans and mortgages, meaning you pay more. The interest paid to those with savings also goes up, so the news could be good or bad, depending on your personal circumstances.

No, it will depend on the type of mortgage you have.

Fixed-rate mortgage holders won’t see any immediate change. Your interest rate will remain the same for the remainder of your agreed term, however, when that term comes to an end, you may find that the product you are moved to is now more expensive than you expected. Depending on the penalty fee for ending your contract early, it may still be worth switching to a longer-term deal to protect against any future increases.

Those on a tracker mortgage will see an increase of 0.25% as tracker mortgages (as you may expect) follow the base rate.

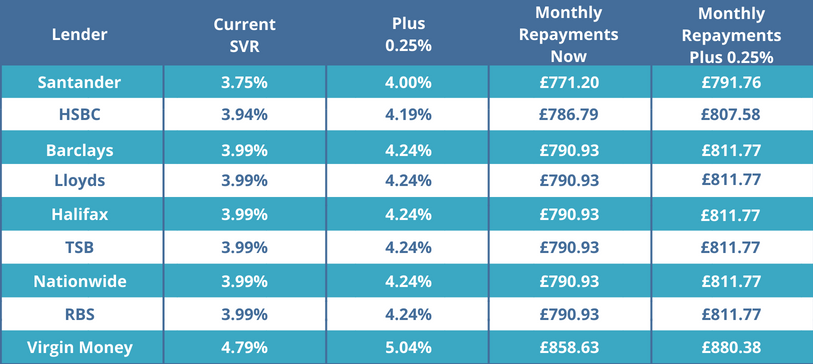

For people on a standard variable rate (SVR) mortgage, your rate is set by your lender and is likely to rise. Most lenders indicate that their SVR mortgages will see an increase of 0.25%, and this increase could happen as early as next month. This will depend on who your mortgage loan is with, as each lender will react differently - you should check with your mortgage provider to find out your rate will be affected. Below is a table showing the possible changes to monthly repayments, assuming lenders increase their SVR mortgage rates by the suggested 0.25%:

*Statistics provided by Moneyfacts

Although the increase in the base rate will see a lot of the best recent deals withdrawn, there are still plenty of attractive mortgage products available. Rates have slowly been creeping up since the last rate hike in November last year, but many fixed-rate deals remain very competitive.

As an independent advisor, we have access to all the available deals at any given time. So, if you’re looking to buy your first property or remortgage your current one, it’s worth having a chat with us about your options. This way, you can be confident that you’re getting the best possible value. Use the button below to book a consultation with us at one of our offices in Preston, Southport, or Garstang:

When it comes to selling your home, it’s easy to focus on the interior and forget about outdoor assets such as the garden. However, as summer approaches, potential buyers will be expecting to see your property’s outdoor space looking its best.

You don’t need to be an Alan Titchmarsh or Charlie Dimmock type to get the garden in top condition, though. Instead, just follow these simple steps and soon the exterior of your property will be just as gorgeous as the interior:

Lawns are a huge selling point and especially desirable to those with young children. They quickly start to look a mess though, if left untended. Pick a dry day and mow the grass, pulling out any weeds as you go. Collect the cut grass and dispose of/recycle it to prevent it from blowing around the garden or trapping moisture and making your lawn soggy. Remember to check any flowerbeds for weeds, too. If your lawn is looking patchy, spread some grass seed to return it to its former glory.

Most gardens have paving or concrete somewhere, and without regular maintenance, it can become a bit of an eyesore. To bring it back to life, buy/rent/borrow a power washer and blast the dirt and moss away! This is a task which, once completed, will have the maximum impact for minimum effort. It’s also a good idea to give any decking a wash at the same time, as it can become discoloured and slippery after the winter months.

Garden sheds and garages are highly sought after, but they often end up being a dumping ground for seldom-used tools/bikes/garden machinery. A messy space makes it difficult for a potential buyer to picture how they would utilise it themselves, so it’s a good idea to sort through any junk before your property goes on the market. Remove and dispose of any unwanted items, and arrange what’s left in an orderly manner. This way, viewers are free to imagine their own possessions being stored in there, rather than being distracted by the sight of rusty bicycles and broken lawnmowers.

Large areas of bare brick can make a space feel small. Try hanging mirrors on these uninspiring blank canvases to reflect the more interesting areas of your garden and create the illusion of increased space. Just remember to give them a wash every now and again to keep them looking their best.

If you have some outdoor furniture, clean it up and set it out. When you’re expecting viewers, scatter some cushions and put some glasses and a bottle/pitcher on the table. Candles also look great if you have a late viewing. Having your entertainment space set out in this way makes it more inviting for viewers and gives them an idea of how the space can be used.

Solar-powered lighting can be sourced relatively cheaply and will add a sense of tranquillity to the garden at night. Although most of your viewing will likely take place during the day, night-time photos can be used in your marketing materials and will advertise your property’s potential when it comes to entertaining during the summer. If your garden has any especially-striking trees, try uplighting them to create a stunning focal point.

Bins aren’t the most attractive feature of the garden, but it’s often difficult to hide them. If you don’t have somewhere discrete to store them, give them a wash and line them up neatly in the least-intrusive place possible. Putting some washing powder or bicarbonate of soda in the bottom of your bins will help to eliminate any less-than-pleasant smells.

By following these simple steps, it’s possible to transform your garden into a wonderful summer retreat in just a day or two, and it will go down a treat with viewers! Once you’ve found a buyer for your home, don’t forget to get in touch with us to make sure you get the best possible deal when it comes to mortgaging your new one!

Spring has sprung (finally!) and it’s the time of year when many homeowners start thinking about redecorating their property to breathe fresh life into their living space. With that in mind, we’ve curated a list of our favourite interior design blogs, packed with inspirational ideas to get your creative juices flowing:

First published in the UK in the early 1950’s, House Beautiful is one of the most popular home and lifestyle magazines available today. Their website is packed with useful information on interior design, renovation ideas, the latest design trends, and gardening tips. You’ll also find the occasional recipe and inspiration for your next holiday.

This one’s for those who love country living; covering interior design, lifestyle tips, gardens, wildlife, and sustainable living, it’s a one-stop-shop for anyone who adores the countryside. They also provide information on exciting rural events, great for planning days out during the springtime! This one will be of particular interest to those with a passion for sustainable living.

Focused on stunning Scottish design, this publication is available to read online as well as in print form. Regularly featuring case studies on magnificent Scottish properties and with plenty of information on where to buy the included fabrics and furnishings, you’ll never be short of design inspiration.

This gorgeous blog by Melissa Michaels was voted “Readers’ Favourite Decorating Blog” by Better Homes and Gardens two years running! Melissa says she started the blog “to inspire women to love the home they have” and she certainly inspires us with her regular creative articles.

Decorilla offer an affordable interior design service whereby professional designers curate a shopping list of furnishings and render them in a 3D virtual environment so you can get a feel for how they would look in your home. Their blog features some stunning designs from the pros and is sure to spark your creativity.

Hunted interior is run by Kristin Jackson, a former International Hotel Designer, who started the website “to inspire readers on hunting for their own style and how to accomplish it on any budget.”

Voted as one of the best interior design blogs to follow by both Better Homes and Gardens, and Domino Magazine, Hunted Interior is chock full of fantastic design, renovation, and DIY ideas

This chic design and lifestyle blog won “Best International Blog” at the Amara Interior Blog Awards back in 2014 and has only gone from strength to strength since. Writer and editor Igor Josifovic has a wonderful eye for style, and often shares insightful travel tips as well as interior design inspiration.

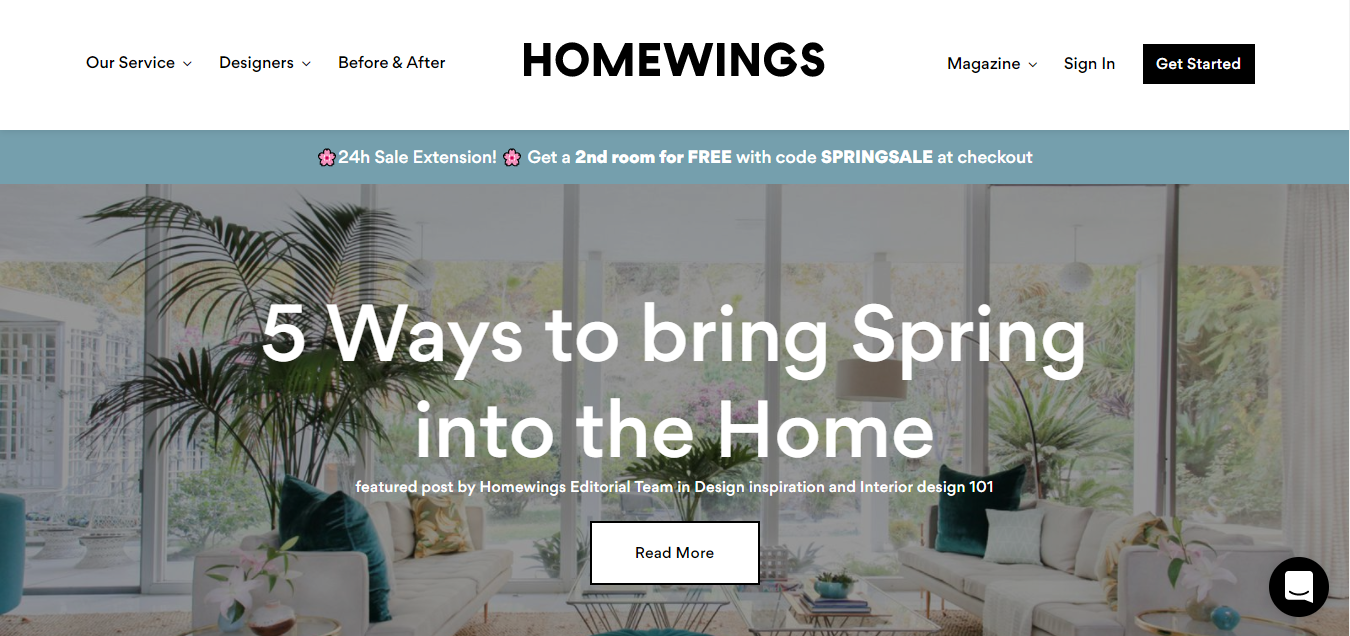

Similar to the aforementioned Decorilla in that they offer a professional interior design service, Homewings is UK based and has tons to offer in terms of inspirational design ideas. They also have some great interactive features like regular competitions and a style quiz, but you’ll need to create a free account to access these.

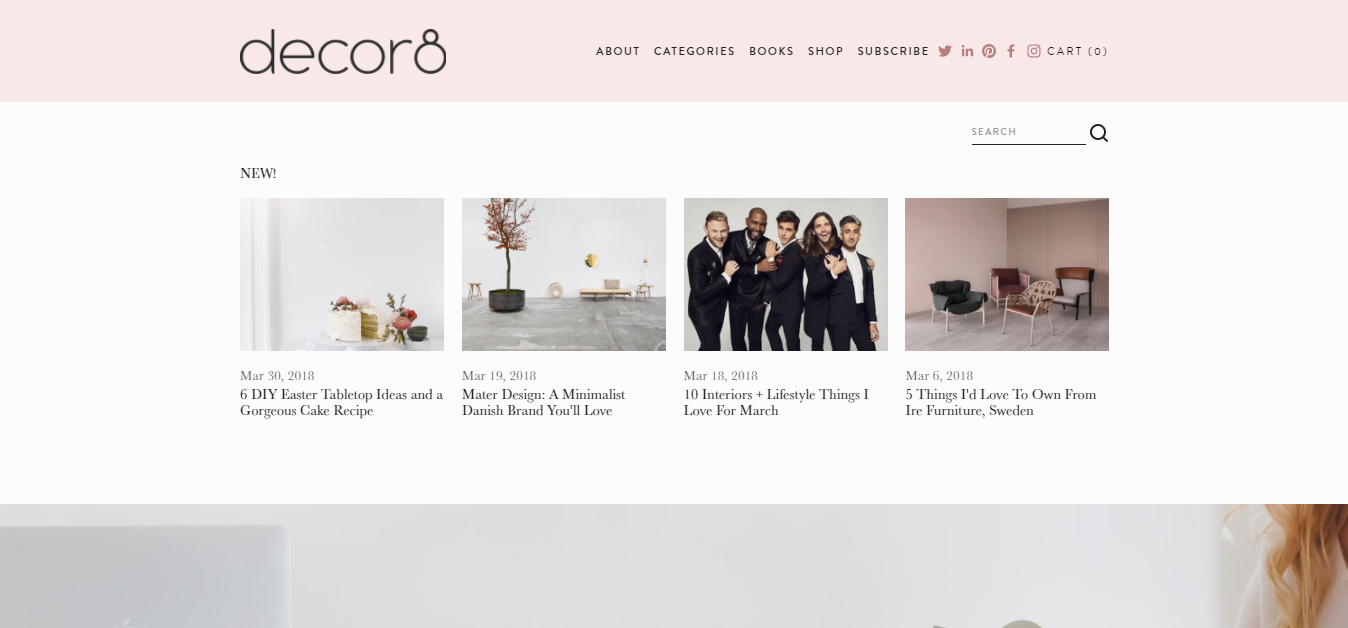

Started by Holly Becker back in 2006, decor8 features content from a diverse team of international interior design experts. They cover everything from new trends to incredible home tours and have a range of four books for those who aren’t satisfied by the immense amount of content available on the blog.

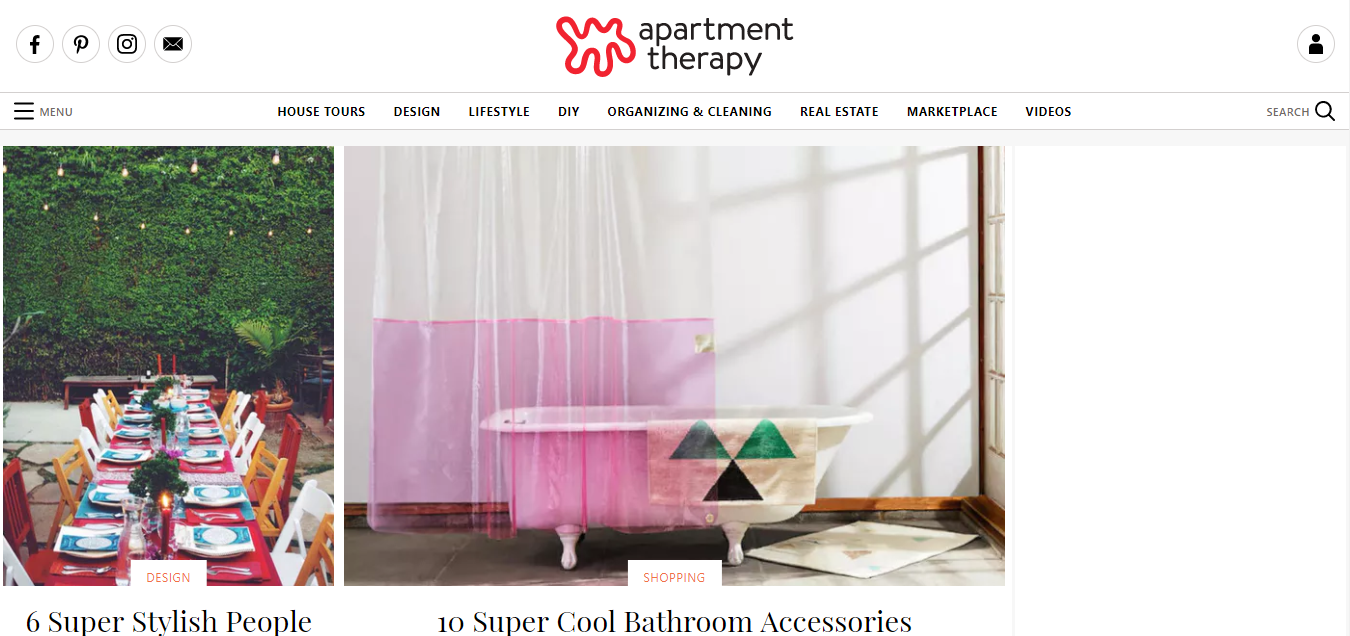

A quirky, US-based blog, Apartment Therapy offers house tours of the rich and famous as well as design, lifestyle, and DIY tips. Their content is always fun and easily digested, and the site is definitely worth bookmarking for when you want some quick inspiration or an entertaining lunchtime read.

For more amazing interior design resources, check out our pick of the best blogs from last year, here.

First-time buyers are enjoying a period of increased mortgage application acceptance and low interest rates at present. However, looking forward, market conditions suggest that this could come to an abrupt end in the near future. For this reason, we feel that now represents the best opportunity for people to get their foot on the property ladder.

We’ve laid out the important factors below, to give you insight as to why you should consider getting your mortgage application in as soon as possible, to avoid being left disappointed:

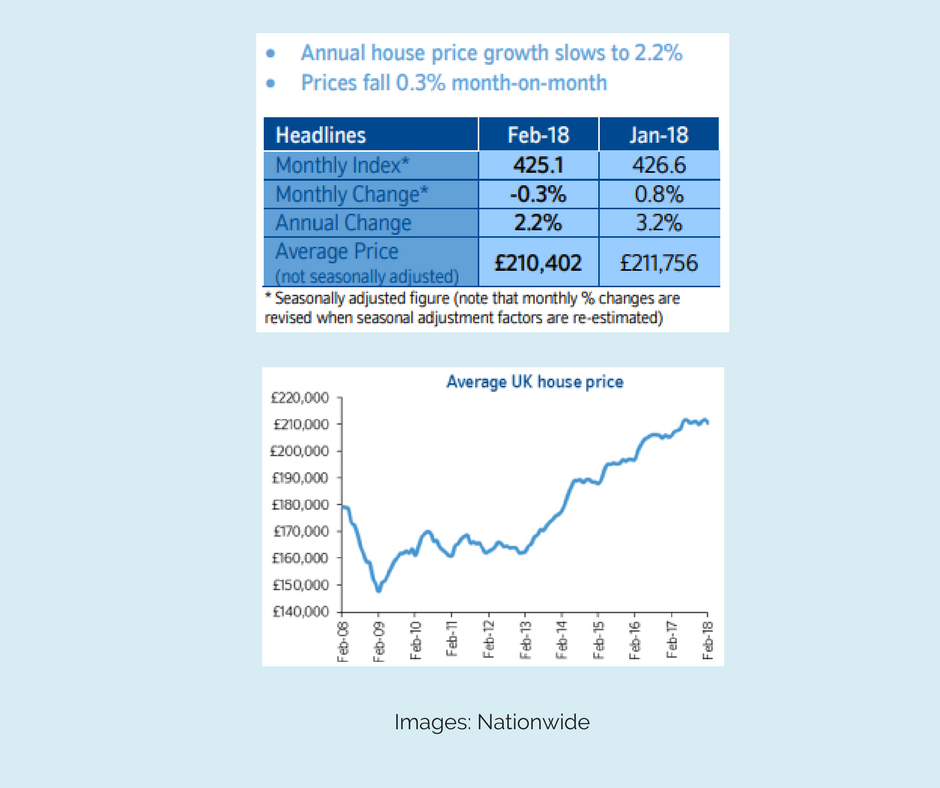

The average price of property has been increasing steadily year-on-year, with prices up 2.2% from this time in 2017. However, the month-on-month statistics show a change of -0.3% from January to February, according to Nationwide. With property prices expected to continue rising, this stall in growth represents a great opportunity to enter the market and get a good deal on a property:

First-time buyers are enjoying a period of high mortgage approval rates at the moment, with 74% of applications through a broker being approved in Q4 2017. That’s an incredible 21% increase from the same period the year before!

Data from the Intermediary Mortgage Lender Association (IMLA) suggests that this is due to a number of factors including low interest rates, improved product availability, and competition between mortgage lenders. This has improved access to mortgage finance overall, boosting the hopes of first-time buyers.

Whilst this is excellent news, it’s unlikely that this trend will continue for too much longer, meaning that potential buyers should be quick if they want to capitalise on the increased likelihood of their mortgage application being accepted.

The reason that mortgage acceptance rates are likely to stall in the coming months is that the Bank of England have hinted at a possible interest rate increase in May. They also suggest that interest rates are to continue to rise in the future.

The base rate was raised in November last year, from 0.25% to 0.5%, paving the way for further increases in 2018. As interest rates rise, first-time buyers will find their mortgage applications increasingly scrutinised, possibly leading to a decrease in rates of acceptance. Analysts expect the base rate to be at least 1% come the end of 2018, so now represents the best time to apply.

Despite the expected base rate increase, interest rates on mortgages currently remain low, with lenders undercutting each other in what remains a highly-competitive market. Due to this, the base-rate hike in November had less of an impact on mortgage rates than expected:

However, further increases would likely see the best deals removed from the market and replaced with costlier alternatives, again suggesting that now is the perfect time to get your foot on the ladder.

If you’re considering purchasing a property, we can help you to find the best deal and give you the greatest possible chance of having your mortgage application accepted. Visit our “Contact Us” page for information on how you can get in touch.

Key Mortgage Advice would like to extend our sincere thanks to everyone who helped to make our Selling Workshop, which took place on Thursday, February 1st, such a special event.

When we started planning the event back in December, the aim was to give something back to our new community in Southport and the surrounding area. We’ve been welcomed so warmly by the neighbouring businesses and residents, that we thought it important to reciprocate by inviting locals to get to know us a little better. At the same time, we wanted to offer them the opportunity to take advantage of some free advice and special offers. The resulting event was a spectacular success, with dozens of people leaving with valuable knowledge. Hopefully, we’ll see some successful property sales around Southport in the near future as a result!

We’d like to offer special thanks to McGuire Estate Agents for affording us use of their gorgeous office as a venue and their expertise as property advisors. Owner Gavin McGuire was on top form, as usual, bringing his unique brand of enthusiasm and humour to the Selling Workshop. Property has never been as entertaining as when Gavin has the limelight; we think someone should give him his own show! The 0.75% selling fee they offered to attendees was incredibly generous, and no doubt appreciated by those who took advantage.

Napthens LLP are owed a huge “thank you” for offering up two of their top solicitors for the event. Legal responsibilities around selling a property can be a real headache, but many people walked away feeling confident after speaking to the pair of Napthens solicitors, who made everything easily understandable by cutting through some of the legal jargon and personalising their advice.

Also deserving of thanks are our own team at Key Mortgage Advice; none of this (from our expansion to the events we host) would be possible without them. Angela Wharton, one of the mortgage advisors in our Southport office, gets a special mention for representing us on the night! Our marketing team at WestCoastCo did an outstanding job of designing promotional materials and spreading the word across our social channels, so here’s a shout-out to them, too!

We’re extremely grateful to The Great Place on Hoghton Street for providing complimentary coffee and cake for the event. All of the refreshments were nothing short of divine; they certainly went down well with the customers (and the hosts)! ?

Finally, thank you to all the local residents who joined us and helped turn our little idea into a roaring success! We’ve been overwhelmed by the welcome we’ve had since opening a new office in Southport. Meeting the locals and being able to give something back has been the highlight of our year, so far. We intend to hold more events and workshops throughout the year, hopefully, we can build on the success of the Selling Workshop and get even more people involved in the next one!

To stay up-to-date with news and events from Key Mortgage Advice, follow us on Facebook, Twitter, and LinkedIn.

What an exciting year it's been! With 2017 almost over and everyone resting before the new year, we thought it the perfect time to have a look back at the last twelve months and share all the things we got up to...

This year saw Key Mortgage Advice grow when, back in November, we opened a new office on Hoghton Street in Southport. The town is going through a period of regeneration and had a stellar year itself, with many new businesses moving in and developments being given the green light. Southport should blossom once again in the coming years, and we’re armed to help people get a great deal on their own seaside property.

For a little peek inside our new office and details on where you can find us, check out our last blog post:

We love a good event, and last year Key Mortgage Advice partnered with various local businesses to host several of our own. Vincents Solicitors hosted a wine and cheese event alongside us at Cobblers Café Bar in Garstang, as well as offering retirement planning advice with us at Barton Grange Garden Centre. Both events went down a treat, but we didn’t stop there...

Not content with hosting one-off events, we experimented with a month-long “Ask the Experts” thread on our Facebook page, with ourselves, Napthens Solicitors, and Lime Estate Agents offering our followers the opportunity to ask our advice on property or finances. It was an ambitious project and one we learned a lot from. Our followers are important to us and it was great to engage with them in a new way and give something back to the people who support us.

We’re currently planning an event in Southport for people who are looking to sell their home in 2018. Keep an eye out for our next blog, when we’ll be ready to share the details with you! We’ll be hosting a number of events throughout 2018, to stay up-to-date, like Key Mortgage Advice on Facebook.

Our blog is where we share the latest industry news, tips for homeowners and house-hunters, and interior design inspiration (amongst other things). 2017 provided us plenty of opportunities to share our insights, with changes happening in the industry and new design trends popping up here, there, and everywhere. Here’s a selection of our most popular posts from 2017:

- Our definitive guide to the best, most-innovative interior design blogs on the web.

- We share our thoughts on new-build homes and whether they're the right choice for first-time buyers.

- Insight into how the interest rate increase affects different mortgages.

- A guide on how to take stunning photographs of your property.

- Inspired by the opening of our Southport office, we look at key areas for consideration when buying commercial property.

We post twice monthly on our blog. All posts are shared on our social channels: Facebook, Twitter, and LinkedIn. You can find all our blog posts on the News page on our website.

January 2018 sees two causes for celebration. Angela Wharton, one of our mortgage advisors based in Southport, has been with us for a whole year, next month; how time flies! We’d like to thank Angela for her hard work this year. Hopefully, she’ll be sharing many more work anniversaries with us in the future!

It’s also Key Mortgage Advice’s birthday in January! We’re turning seventeen and would like to take the opportunity to thank all of our customers, our social media followers, the businesses we’ve worked with, and anyone else who has helped us get to this point and supported us along the way. We couldn’t have done it without you!

We hope you’re all enjoying the holidays and wish you all a wonderful new year! We’ll be back in the office on Tuesday, January 2nd. If you’d like to leave us a message before then, email us at [email protected] or contact us on Facebook and we’ll be sure to get back to you ?

Back in November 2017, we opened our third office location. Part of our long-term plan for expansion, opening an office in Southport allows us to offer our services over a wider area, having established ourselves as a leading mortgage advisor in the Preston and Garstang areas over the preceding 16 years.

The area has been enjoying a boom, with several high-profile businesses opening new stores in the beautiful seaside town. House prices in Southport have been steadily increasing too, with an average rise of 6% compared to the UK average of 1.4%, meaning it’s growing in popularity with commercial investors and homebuyers alike. It’s not surprising really, with Southport being sandwiched between the city attractions of Liverpool and the gorgeous Lancashire countryside. With so much potential in the area for property investors and house-hunters, we thought our services as independent mortgage advisors would be of benefit to the local community.

Now for the exciting part; let's take a look inside:

With a little help, we renovated the new office and decorated it in blue and white to match the Key Mortgage Advice branding. We also installed a separate consultation room so that we can offer our customers some privacy. We wanted to get the office up-and-running as quickly as possible and, thanks to the incredible work of the renovation team, we were able to complete our renovations in under two weeks!

We’ve thoroughly enjoyed meeting our neighbours on Hoghton Street and helping the locals with their mortgage enquiries. If you’re looking for an independent mortgage advisor in Southport or the surrounding area, you can find us just around the corner from the train station:

Call Key Mortgage Advice Southport on 01704 829888 or email us at [email protected] to book a free, no-obligation consultation. Contact details for our offices in Preston and Garstang can be found here.

On November 2nd, the Bank of England increased the base rate from 0.25% to 0.5%. This is the first increase in over ten years and could pave the way for further increases in the not-too-distant future.

In reference to this, the Monetary Policy Committee has said: “Any future increases in interest rates would be at a gradual pace and to a limited extent.”

Put simply, the base rate is set by the Bank of England Monetary Policy Committee and is the official interest rate used by Banks and Building Societies to calculate the rates for their products (mortgages, savings accounts etc.). Often, when the base rate goes up, so does the interest you pay on loans and mortgages, and the interest paid to savers.

No, it will depend on the type of mortgage you have.

Those on a tracker mortgage will see an increase of 0.25% as tracker mortgages (as you may expect) follow the base rate.

People on a standard variable rate (SVR) mortgage, your rate is set by your lender and is likely to rise. Most providers indicate that their SVR mortgages will see an increase of 0.25%, although many won’t change their rate until December 1st. This will be dependant on your mortgage provider and you should check with them to find out your rate will be affected.

Fixed-term mortgage holders won’t see any immediate change. Your rate will remain the same for the remainder of the agreed term, however, when your fixed term comes to an end, you may find that the product you are moved to is more expensive than you anticipated.

If you don’t already have a mortgage and are looking to get on the property ladder, then this news isn’t great for you. It’s likely that many of the best recent deals will be withdrawn and replaced with higher-priced products. However, the increase isn't huge, so you shouldn't have to pay too much more than you would have at the old rate. An independent advisor can help you to find the best deals across the whole of the market.

Although the increased base rate will see a lot of the best recent deals withdrawn, there are still plenty of attractive mortgage products available. As an independent advisor, we have access to all the available deals at any given time. So, if you’re looking to buy your first property or remortgage your current one, it’s worth having a chat with us about your options. This way, you can be confident that you’re getting the best possible value!

To learn more about our new Southport office, take a look at our press release on Lancashire Business View.

The North West is home to some of Britain’s most haunted properties, most of which are open to the public for tours and/or functions. With Halloween looming, we take a look at some of these spooky buildings and the legends which surround them.

Located in Goosnargh and formerly known as Singleton Hall, this grade II listed manor house was built around 1260 by Adam de Singleton and holds the title of the most haunted house in Britain. The house remained in the possession of the Singleton family until the 16th century when Eleanor Singleton, the last of the bloodline, was murdered within. Ownership of Chingle hall then passed to the Wall family.

The house is said to be haunted by the ghost of Eleanor Singleton, held captive in one of the bedrooms for twelve years and eventually murdered there. People have reported seeing her ghostly apparition and feeling her holding their hand or tugging at their clothing. Eleanor’s bedroom is thought to be the most haunted room in the house.

Reports of a hooded monk wandering the hall are also common, often accompanied by the aroma of incense. This is presumed to be the ghost of Father John Wall, born in the house in the 17th century and later hanged for heresy. His head is said to be buried within the hall’s grounds and legend has it that when the head is found, the hauntings will stop.

The house is now owned privately and is no longer open to the public.

The land on which Hoghton Tower stands is located just outside of the village of Hoghton, near Preston, and has been owned by the de Hoghton family since the 12th century. The current residence was built between 1560-65 and has been grade I listed since 1952. The family moved out of the house in 1768 and it was rented to local farmers for many years.

It was later left derelict before being inherited by Henry de Hoghton in 1862. Henry oversaw the restoration of the house, which was carried out by Lancaster architects Paley and Austin between 1876 and 1880. Further works were later carried out by a number of architects, mainly on the stables and other surrounding buildings.

The house is said to have been visited by several prominent figures over the years, most notably William Shakespeare and Charles Dickens, however, guests are often more interested in the ghostlier inhabitants. There have been many sightings over the years, with a little girl, a woman known as the “green lady”, and a monk said to make regular appearances. These apparitions are so common in fact, that staff there keep a record of them in a “ghost file”.

Hoghton Tower is open to the public for corporate and private functions, and also offers the occasional ghost tour! More information can be found on the Hoghton Tower website.

This historic manor house, located in Samlesbury, near Preston, was built in 1325 by Gilbert de Southworth. The house remained with the Southworth family until the early 17th century, thereafter seeing use as a weaver’s mill, a public house, and a boarding school, before being purchased by the Samlesbury Hall Trust in 1925 to prevent its demolition.

The hall is said to be haunted by the spirit of Dorothy Southworth, known affectionately as the “white lady”, who reportedly died of a broken heart after her brother killed her lover and his two friends. Three skeletons were found within the hall’s walls, giving the story some credibility.

Other sightings have included have included the ghost of a woman and her child, and a decapitated priest. The blood of the latter is said to stain the floor of the room now known as the “priest room”.

Samlesbury Hall is open to the public for visits and functions. A virtual tour of the building can be taken on the website.

This grade I listed manor house is located in Smithills, Bolton. Records of the house began in 1335 when it passed to William Radcliffe, but the exact time of its construction is unknown. The house was used as a private residence until 1938 when it was purchased by Bolton Corporation. It was then used as a residential home and day care centre until closed in the 1990s. The property is now owned by Bolton Metropolitan Borough Council.

Smithills Hall is said to be haunted by the spirit of George Marsh, a preacher, examined in the hall before being tried for heresy and executed in 1554. Within the grounds of the hall remains a footprint, reportedly left by Marsh. The footprint is said to fill with blood every year on April 24th, the anniversary of his death.

The hall is open for public tours, more information can be found on the Smithills Hall website.

Once known as Britain’s most haunted hotel, The Birkdale Palace was built in 1866 on the coast of Birkdale, Southport. The hotel was used as a rehabilitation centre for US soldiers during WWII, after which, it was visited by several Hollywood legends, including Frank Sinatra, Clark Gable, and Peter Sellers.

There were several morbid tales involving the hotel. It is said that the architect, William Mangnall, is said to have committed suicide when he realised that it had been built with its grand entrance facing inland, rather than out to sea as he had planned.

The most horrifying occurrence, the murder of local girl Amanda Graham, happened in 1961 at the hands of Alan Victor Wills, a porter at the hotel. The hotel’s reputation never fully recovered after this terrible incident and the hotel was subsequently demolished in 1969.

The only remaining part of the hotel is the old coach house, which now serves as a pub called The Fisherman’s Rest, itself named after a tragedy dating back to 1886 when 14 lifeboatmen died off the coast of Southport.

We hope you've enjoyed learning about some of the North West's spookier properties! If you're looking for a new (ghost-free) home in the North West or beyond, and need some impartial mortgage advice, drop into our offices in Preston, Southport, or Garstang for a chat. Alternatively, you can contact us via telephone or email - details on our contact page.

We all need a little interior design inspiration from time to time, whether we’re preparing our property for sale, or just looking to freshen up our home.

There’s no shortage of stylish websites and blogs filled with tips and trends, and looking through them all for design ideas can be a tiresome task! To save you from becoming overwhelmed, we’ve curated a list of our favourite interior design blogs that you can bookmark to use as a reference in your future projects!

Heart Home

Heart Home is an online home and lifestyle magazine that has been around for several years now. It’s a great place to keep up with the latest trends, as they often do spotlight articles for new collections available in stores and online. Their blog includes an interior design section which is second-to-none, offering style ideas to suit a variety of tastes.

Design Milk

If you’re looking for inspiration in any area of life, Design Milk has you covered. The website is vast and covers many topics such as art, technology, and travel. Their section on interior design offers a look at some high-concept spaces as well as offering advice on more conventional design trends. If you’re looking to create something unique, Design Milk is a valuable resource.

Design Sponge

Design Sponge is an amazing resource for all things design. Especially exciting is their DIY section, with tutorials on how to make your own unique design elements for your home. On top of a huge selection of practical tutorials, you will also find a fantastic range of design-related articles to get your creative juices flowing! It’s worth visiting the site regularly as new tutorials are uploaded regularly.

The Beat That My Heart Skipped

The final blog on our list, The Beat That My Heart Skipped, is a beautifully curated selection of interior style articles which highlights new collections available on the high street. Focussing mainly on homeware, it offers an abundance of inspiration when it comes to adding those finishing touches.

Once you’ve completed your interior design project, you’ll want to be able to take the best possible photographs in which to show it off! You can find our guide on taking better property photographs here.